By Dr Patrik Frei, expert-trainer of Pharma-Biotech Product & Company Valuation

In the dynamic landscape of the life science industry, valuing companies and products in development accurately poses a unique challenge due to the inherent complexity and unpredictability of the sector.

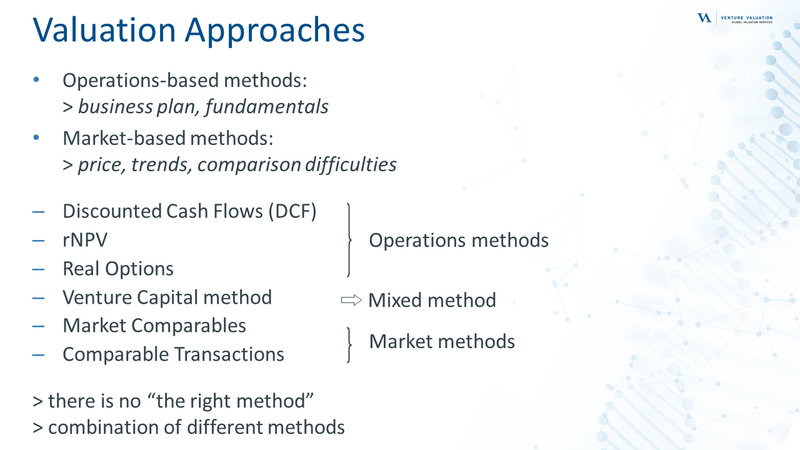

Typical valuation methods that are used fall into distinct categories, each offering insights into different facets of a company's worth. However, a singular approach rarely captures the full spectrum of value. Instead, a combination of diverse valuation methods is recommended.

There are 2 types of methods in valuation:

Operations-based methods

Operations-based methods delve into the intrinsic value of a company, often focusing on its business plan and fundamentals. This approach assesses the viability and potential success of a venture based on its operational framework. It scrutinises the efficiency of operations, cost structures, and revenue models outlined in the business plan to estimate future cash flows. However, while these methods provide a detailed view of internal workings, they might overlook external market influences.

Examples of operations-based methods are the Discounted Cash Flows (DCF), rNPV (risk-adjusted Net Present Value), and Real Options. Value is calculated by forecasting future cash flows and discounting them to present value.

DCF and rNPV account for risk by adjusting cash flows, while Real Options incorporate flexibility and managerial decision-making into valuation, considering the potential for strategic choices to impact value.

Market-based methods

In market-based methods, valuation is calculated based on external indicators such as price trends and comparisons with similar entities.

Market Comparables and Comparable Transactions are two such approaches. These methods rely on market data, such as trading prices of similar companies or recent transactions in the industry, to gauge relative value. However, the variability in market conditions and the scarcity of truly comparable entities can limit the accuracy of these assessments.

There is also a mixed method, the Venture Capital method. It combines elements of the above mentioned approaches by assigning values based on potential exit scenarios and expected returns, often used in early-stage ventures where traditional valuation methods may be less applicable due to uncertainty.

No single method stands as the ultimate solution for valuation in the life science industry. Each approach comes with its strengths and limitations. Market-based methods can be affected by market volatility and lack of comparables, while operations-based methods might overlook market sentiments.

In practice, a mixed method approach, integrating various valuation techniques, tends to yield a more holistic view of a company's or product’s worth. By leveraging the strengths of different methods and cross-validating their outcomes, you can mitigate the weaknesses inherent in any singular approach, providing a more reliable valuation framework.