By Gary Johnson and Sam Johnson, expert-trainers of The Pharma Pricing Course.

In pharma, it is very important to understand what “type” of pricing you are dealing with for your brand or product. If you don’t, you will do the wrong type of pricing research – potentially wasting a lot of money and getting the wrong answer.

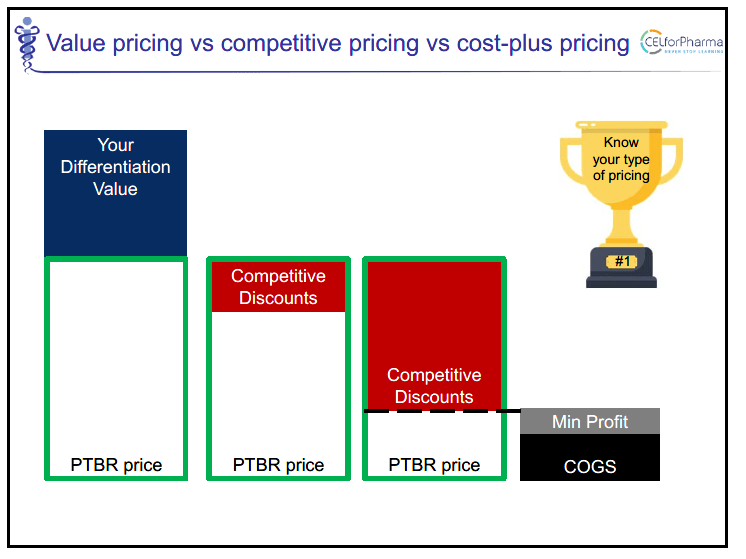

Value Pricing

If you have a product that is an advance over your competition, you can charge a “value price”. This means that you can charge the price of the product-to-be-replaced (PTBR), plus an additional premium based on the additional clinical benefit you deliver. This price premium is known as your “differentiation value”. Estimating this value requires understanding payers’ values.

Competitor Pricing

If your product is clinically very similar to direct competitors, then you will end up charging a “competitive price”. This may very well involve giving a discount relative to your competition. The important thing here is to price so that you don’t get sucked into a price war. The more similar competitors you face, the bigger the discount tends to be.

Cost Plus Pricing

If you are in a market with many similar competitors – for example you have a generic with many competing generics, then prices get competed down so that profits just cover the cost of companies’ capital. In competitive markets, this tends to be around 50% higher than the cost of goods.

If you wrongly assess the type of pricing you face, you can make mistakes. For example, if you think you are value pricing when in fact you are competitor pricing, you can waste a lot of money on expensive, sophisticated payer research.